SHARE ID

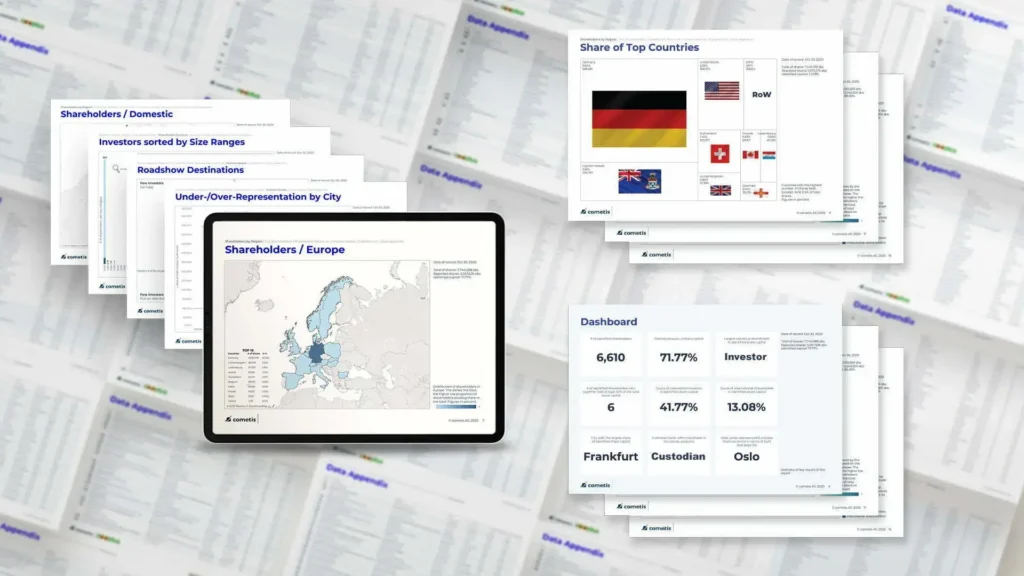

Share ID shows your shareholder structure

An IR department’s most important asset is the trust placed in it by the capital market. In our experience, this is immediately followed by knowing your shareholder structure: “Know Your Shareholder!”. This is exactly what a new investor relations product from our European IR consulting company based in Germany provides you with: a comprehensive, up-to-date presentation and analysis of your shareholder structure. As a result of this extensive analysis, new options are being opened up for all companies by investor relations in order to optimize the shareholder structure in the sense of the defined IR objectives.

When a Share ID makes sense

For one—off occasions such as

- before shareholders’ meetings: four – six weeks before the agenda is approved, it can be used to contact key shareholders (Σ > 50%) and to organize shareholders’ meeting majorities

- for M&A activities/public takeover bids (before and during)

- for special situations: crises, transformation/change processes, board changes

- before/after publication of your annual report

- following special items of company news

or on and on—going basis:

- At the beginning of the year, to plan roadshow activities: Who should I visit? How can I combine and optimize appointments?

- To create regular delta reports: What has changed?

- Possible rhythm: quarterly/monthly/weekly or even daily

Contact us

At your behest, we will be happy to take on the identification process across the complex custody chain of intermediaries i.e. the custodian banks of your shareholders and put together an informative and attractively designed “Know Your Shareholder!” report, which can be presented directly to your management and board of directors.

You can find more information via e-mail at hafer@cometis.de or call us on +49 611 205855-22.