It’s time to wake up – companies can no longer hit the snooze button on sustainability. The longer you put off structural ESG reporting, the further you fall behind and run the risk of losing access to the capital market, failing to comply with increasingly stringent laws, and being sidelined by your business partners.

Keep an overview in the ESG jungle!

Wiesbaden, 03. March 2023. CSRD, SDG, GRI, EFRAG, CDP, ESRS, ISSB, SFDR… The numerous regulations, frameworks and standards, certificates or organizations with which one is confronted around the topic of sustainability and sustainability reporting are reminiscent of the much-cited alphabet soup. Here, it is important not to throw in the towel, but to filter what is really relevant.

The legislators are pressing ahead!

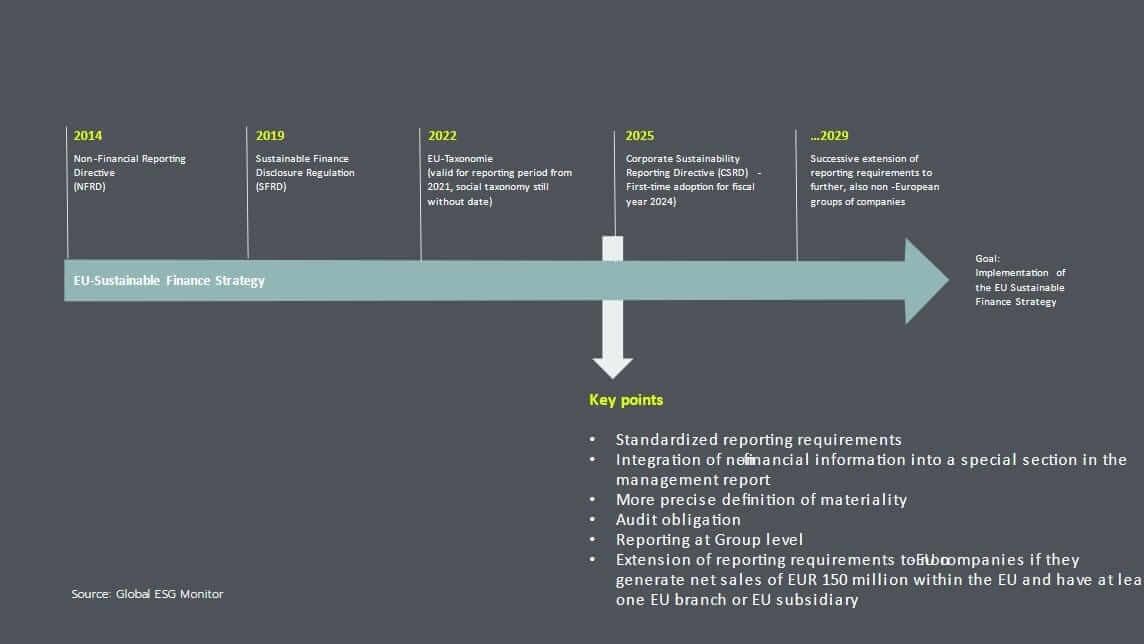

For companies in Germany, the directive currently still in force is the European Union’s Non-Financial Reporting Directive (NFRD), which was transposed into German law in 2017 by the CSR Directive Implementation Act (CSR-RUG). Under this law, companies with more than 500 employees are required to submit a non-financial statement containing information relating to environmental, social and employee issues, respect for human rights and the fight against corruption and bribery.

In the coming years, the reporting requirements and the number of companies they affect will be massively expanded. As a successor regulation to the NFRD, the Corporate Sustainability Reporting Directive (CSRD) will then gradually come into force throughout the EU. According to the current timetable, the CSRD will apply from 2025 – i.e. for reports for the financial year 2024 – to all companies that are already subject to reporting requirements within the meaning of the NFRD.

One year later – i.e., starting in 2026 and for the reports for fiscal year 2025 – the CSRD will also apply to all limited liability companies, credit institutions and insurance companies that meet at least two of the three characteristics:

- Balance sheet total: at least 20 million euros

- Net revenue: at least 40 million euros

- Average number of employees during the fiscal year: at least 250[2]

Again one year later – i.e. from 2027 and for reports for the 2026 financial year – the reporting requirement will be extended to listed SMEs, small and non-complex credit institutions and captive (re)insurance companies. From 2029 (for annual reports as of the 2028 reporting year), the CSRD will also cover non-EU companies with EU branches or EU subsidiaries if they generate net sales of more than EUR 150 million within the EU.

50,000 companies affected EU-wide – 15,000 of them in Germany!

Finally, the CSRD will extend the reporting obligation from currently around 11,700 to around 50,000 companies in the EU; in Germany, the CSRDwill affect an estimated 15,000 companies – 30 times as many as currently have to report under the CSR RUG!. In addition, reporting companies will be required to have their non-financial disclosures externally audited and to make their sustainability information available digitally.

Pay attention to the frameworks – and the right ones!

While it is regulated by law which companies have to publish non-financial statements, sustainability or ESG reports in the first place, there are still no specifications as to what these reports have to look like or what they have to contain – beyond the information mentioned above. This will change with the introduction of the CSRD, as it will be accompanied by the European Sustainability Reporting Standards (ESRS). These reporting standards, which will apply throughout the EU in the future, are already available in draft form and are largely based on existing and widely used frameworks.

It is therefore important to familiarize oneself with these frameworks today, and not to wait until the introduction of the ESRS to deal with them!

One of the most widely used and detailed frameworks are the reporting standards of the Global Reporting Initiative (GRI)[3]. The GRI itself states that the application of its reporting standards in sustainability reports best prepares companies for the new ESRS standards. The consolidated GRI standards currently comprise more than 700 PDF pages, and the requirements for disclosures in sustainability reports can be broadly summarized into the following topics:

- GRI 1: Fundamentals

- GRI 2: General disclosures

- GRI 3: Material topics

- GRI 201-207: Disclosures relating to the economic dimension

- GRI 301-308: Disclosures relating to the environmental dimension

- GRI 401-418: Disclosures concerning the social dimension

Now that it is clear that reporting is required and how it should be done, many companies may still be faced with the question for whom – apart from the authorities – they actually prepare their sustainability reports. Companies should be aware that the requirements of important stakeholders go far beyond the legal obligations.

Investors are thirsty for data – and they want it now!

Even more serious than the legal obligations is the pressure from the capital market, both in terms of equity financing and debt financing. If you want to secure access to any form of financing for your company in the medium term, and you have not yet established appropriate sustainability reporting structures, you are late to the party, to say the least.

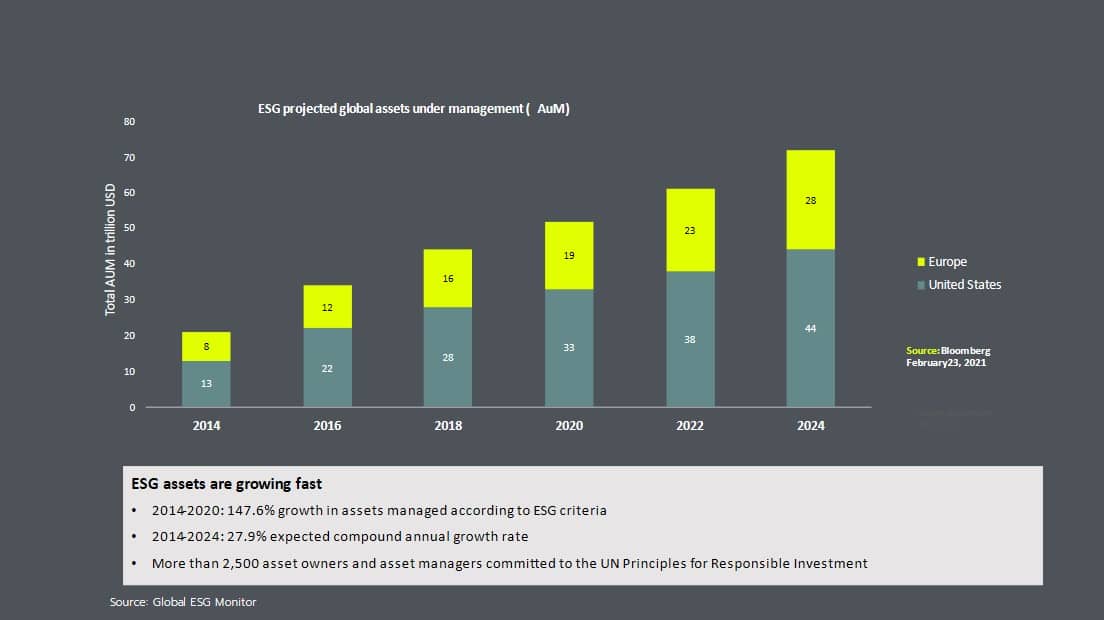

In the period from 2014 to 2020, ESG assets under management worldwide increased by around 150% and, according to expert estimates, will account for more than one-third of all assets under management in 2025. But it’s not just the numbers that paint a clear picture.

The fight against climate change is THE defining discourse of our time and will continue to shape society worldwide at least until binding measures against global warming have been adopted and show results. This position is held above all by younger generations, who are increasingly making their way into the offices of the largest asset managers or have assets of their own that they want to invest in the sustainable transformation of the economy. In addition to the desire to help shape this green transformation, risk considerations play into the selection of investments that incorporate ESG factors.

A company that is less vulnerable to the consequences of climate change or contributes little to it, or a company that has established structures to eliminate child or forced labor along the value chain, thus represents a lower investment risk. It is less affected by high CO2 prices or possible “shitstorms” due to unethical behavior.

Don’t lose your clients!

Especially for small companies that are not yet reporting companies and will not be for another four or six years, the temptation is great to postpone dealing with the topic of sustainability. But they should be aware: they are already affected by the same factors that apply to large companies today!

If, for example, a car manufacturer has to report on the conditions in the extraction of raw materials or in the production of intermediate products, it has to rely on information from its suppliers. The deeper you look into the supply chain, the more often you will encounter smaller companies that have probably never collected the required data. But if a company at the top of the supply chain is unable to provide information because of this, it faces the threat of a lower sustainability rating, which in turn makes financing via the capital market more difficult. As a result, the pressure is passed along the value chain, so that small companies ultimately run the risk of losing business relationships with their most important clients.

Thus, it should be self-evident: The case for establishing the structures for effective and transparent ESG reporting as soon as possible is overwhelming – and no company, no matter how large or small, can afford to ignore it any longer.

Do you need consulting on the structured setup of sustainability reporting for your company? Then cometis is the right contact for you: We will be happy to answer your questions!

Michael Diegelmann: Founder and Board Member

Michael Diegelmann has taken over 50 companies public and gained experience in over 250 investor relations and ESG projects. He has been active in the field of capital market communications since 1997 and is a proven expert in ESG topics.